Responding to shifting consumer expectations and technological advancements, the contemporaneity of the global luxury market is marked by its ability to blend heritage with innovative digital experiences. This evolution presumes offering a wide range of utilities to enhance the brand’s customer journey, thereby elevating the overall experience at every touchpoint.

Attaining the discerning modern consumer in the field of fine jewellery requires a nuanced approach that delves into more immersive offerings, with brands in this niche actively utilising digital tools to spark an emotional brand-consumer connection on another niveau.

Understanding NFTs and their appeal in the context of luxury

Among other immersive metaverse environments, the integration of Non-Fungible Tokens (NFTs) offers unique layers of digital engagement to traditional luxury artisanry. NFTs seamlessly blend timeless craftsmanship with cutting-edge technology, further reinforcing a brand’s commitment to delivering tailored and exceptional experiences beyond physical offerings. In the fine jewellery sector, NFTs can offer a digital representation of bespoke creations, adding more depth to the brand’s storytelling narrative.

Purchasing an NFT means aquiring an exclusive ownership of a unique digital asset. As NFTs represent a one-of-a-kind digital item that cannot be exchanged, this exclusivity appeals to luxury buyers who value authenticity and uniqueness. Stored on the blockchain, NFTs are decentralized, transparent, and identifiable; their transaction history over time, origin, and legitimacy can be easily verified by any third party. By integrating NFTs, fine jewellery brands can expand their storytelling, adding a digital dimension to their luxury pieces.

How fine jewellery frontiers embrace NFTs

- Tiffany & Co.’s NFTiff

Tiffany & Co.’s collaboration with CryptoPunk was launched to further personalize the luxury experience for tech enthusiasts. This partnership provides a compelling offering – digital twins – 250 NFTs that represent a digital version of a physical jewellery piece. The project allowed CryptoPunk holders to personalise their digital avatars and turn them into custom necklaces. These digital collectibles are paired with real-world pendants, crafted with precious gemstones and diamonds.

- Bulgari High Jewellery NFT

Like Tiffany & Co., Bulgari’s venture into the metaverse with its capsule NFT collection demonstrates the brand’s commitment to digital artistry. Designed by Bulgari’s creative director Lucia Silvestri, in partnership with Milan-based startup Miat, these intangible blockchain offerings engage consumers by allowing them to experience bespoke jewellery artworks in a virtual realm.

- Bäumer Vendôme NFT

Bäumer Vendôme, a high-end Parisian jeweller, launched an innovative phygital NFT collection in collaboration with Ledger, Societhy, and Next Decade. Inviting customers to explore new realms of creativity, this collection offers unique NFT rings coupled with their physical counterparts. The uniqueness of this offering also lies in the ability to join an exclusive club with the purchase of an NFT, which provides additional customer value.

Is the NFT trend over?

One might argue that the NFT phenomenon, which witnessed skyrocketing sales in the past, has now settled down. Yet, what does it mean for the luxury market sector in particular?

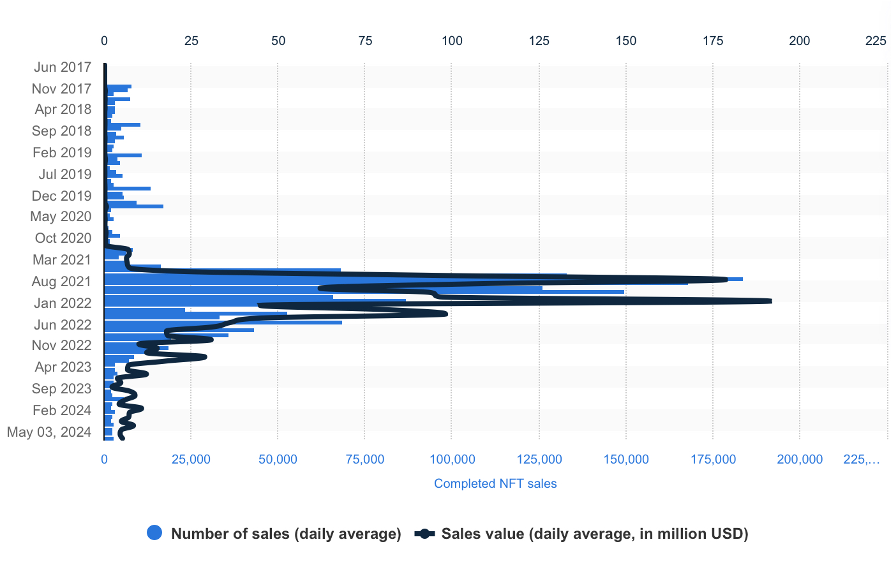

The German online-platform for statistical data Statista reports significantly lower NFT transaction rates in 2024 compared to their peak throughput volume in 2021 and 2022. This slowdown in overall sales figures across non-fungible tokens may determine whether their further integration into luxury industry practices will remain viable and profitable. Lower transaction volumes can signal a lack of demand from the digitally native consumers, which may lead to perceived discrepancies between luxury brand values and NFTs that could be seen as less desirable, exclusive, or valuable. In turn, this factor could make companies in this market sector more reluctant to invest in NFT projects in the future.

What are the hurdles of maintaining NFT sales?

While the NFT market may represent volatile and rapidly changing landscape, maintaining constant sales is further complicated by several challenges:

- Unsustainable Business Practices: NFTs have been criticised for their negative environmental impact due to the energy-intensive nature of blockchain network technology, particularly among environmentally conscious consumers.

- Uncertainty and Hesitation: Due to the complexity of NFT purchasing process, many consumers remain doubtful about navigating the NFT market landscape. Combined with scepticism about the viability of the investment and an overall knowledge gap in how NFTs are purchased, stored, and used, this can discourage potential customers from adopting this practice.

Can digital collectibles retain luxury customers engagement?

While the apparent sales deceleration may compel the luxury industry to seek digital presence on other virtual grounds, it does not necessarily spell the end of NFTs in this market. As the Aura Blockchain Consortium stated in 2023:

“Having an NFT strategy is no longer an option but a necessity to keep up with the needs of luxury customers”.

Integrating metaverse commodities into the high jewellery sector, known for bespoke craftsmanship and heritage, might seem an unlikely course of action. However, brands in this niche continue to stand at the forefront of implementing digital assets in the era of Web3; forward-thinking companies have already paved their way into technological advancements to leverage and reimagine the customer experience. The adoption of NFTs thus represents not merely a trend but a bold strategic move in the industry.

Making NFTs a lucrative, unique offering that complements, rather than interferes with, the bespoke artisanry of tangible high jewellery remains a substantial challenge for the market. Whether NFTs in luxury will continue to thrive depends on the industry’s ability to successfully incorporate this innovative asset and keep strong customer engagement without failing to uphold traditional brand values.